Tokenization of assets has emerged as one of the steady Blockchain trends for the year 2019-2020. The concept is opening new doors for tokenization of anything and everything in the marketplace – be it diamond, paintings, or property.

But, how far will it take the market? Will it become a key addition to every business?

Let’s talk about it in this article – starting with a simple definition to what is tokenization.

[While Tokenization is one of the trends to focus upon, you can learn about others via this article: Blockchain Technology Trends in 2019-2020]

Tokenization of Assets – Its Definition and Types

The answer to what is tokenization is that it is a process through which a blockchain token is issued to digitally represent any real tradable asset in a way that you can trade with a single fraction of the asset as well.

The process sounds much like Securitization and Fractional Ownership, but it holds some key differences – something we will cover just before diving deeper into the tokenized world and discussing the token types.

Tokenization vs Securitization

When talking about how tokenization is different from securitization, the former turns all the real world assets into high-liquidity digital token, whereas the latter converts low-liquidity assets into higher-liquidity security instruments that could be traded in markets and over-the counter.

Tokenization vs Fractional Ownership

Fractional ownership, unlike Tokenization, provides an opportunity to bring unrelated parties together to enjoy trading in a digital world.

With the basics of Tokenization now clear to you, let’s look into what are the types of tokens operative in Blockchain environment.

Types of Tokens Circulated and Used in Blockchain World

Tokens are broadly divided into two basis:

1. On the Basis of Nature

-

- Tangible Assets – The term represents a set of assets that holds some monetary value and is available usually in a physical form.

- Fungible Assets – These digital assets are created such that every token is equivalent to the next. Meaning, one bitcoin is equal to one bitcoin and is interchangeable with one bitcoin only.

- Non-Fungible Assets – They are designed as unique and can’t be interchangeable.

2. On the Basis of Speculation

- Currency Tokens – These tokens represent currencies in digital form.

- Utility Tokens – The term refers to a digital token that is issued to support funding for the development of cryptocurrency and can be later employed for purchasing a particular product or service offered by the issuer of the cryptocurrency.

- Security Tokens – Security tokens is basically the digital representation of traditional securities.

Now as we have covered the basics of tokenization, it’s the right time to look into what are the benefits of this process.

Advantages of Considering Tokenization

1. Greater Liquidity

One of the prime advantages of tokenization is enhanced liquidity.

Presently, the market for privately held firms is illiquid. Because of this, it takes more time for buyers and sellers to know about each other and the services they offer.

They also have to spend considerable time into deciding the factors for doing business together and hiring lawyers, and other service providers for building a contract for executing the transaction.

But, with the adoption of the concept of Tokenization, this process becomes smoother and streamlined. It introduces a blockchain platform where tokens represent private company securities and are sold to participants who would have pre-vetted in such areas as authorized investors with adequate capital to take the risk.

These investors can exit the platform anytime by selling their tokens on a secondary market easily and efficiently. They won’t have to suffer from the hassle of early redemption which is an expensive affair.

This, as a whole, will encourage high net worth individuals and agencies to make an investment in private company securities. And ultimately, build a global market for these private securities.

2. Higher Accessibility

Accessibility is also one of the prime benefits of tokenization.

The concept of tokenizing allows fragmentation of assets to the minimum possible amounts in the form of tokens and encourage investors to get a small fraction of shares. This opens doors for different investors and cut down the minimum investment period and amount.

3. More Transparency

In tokenization of assets, the token-holder’s rights and responsibilities are embedded in the contracts that define token attributes, along with a complete record of ownership. This gives you an idea of whom you are dealing with, what power they have, and whom they have purchased this token from. Something that adds transparency to the whole process.

4. No Intermediaries

With the introduction of Smart contracts and characteristics like immutability, tokenization has also reduced the number of intermediaries required in a transaction.

5. Cheaper and Faster Transactions

Since transactions of tokens will be done using Smart contracts, a major portion of the process will be automated. This will cut down the number of intermediaries and the efforts required in administering the whole process. This will eventually result in faster and cost-effective transactions.

Now, while these were the benefits of Tokenization in general, let’s dive into the business side of it and see what it means to different sectors.

Industries That Are Embracing the Concept of Tokenization of Assets

1. Finance

Tokenization is changing the whole landscape of Finance industry- be it margin lending, product structuring, investment, or payments.

The concept facilitates finance organizations with an opportunity to turn all the assets into digital crypto-currencies that could be exchanged seamlessly. It gives merchants an escape from storing the actual credit card numbers in POS machines and other systems. This, as a whole, introduces liquidity in the market and lower down data security breaches.

Likewise, tokenization of financial assets provides users with more than one token issued for the same credit card. Meaning, even if you have used any token on an online website and that portal gets hacked, it won’t be easier to reverse engineer the code and learn the actual credit card number.

A real-world example of this is AlgoZ partnership with OmiseGo.

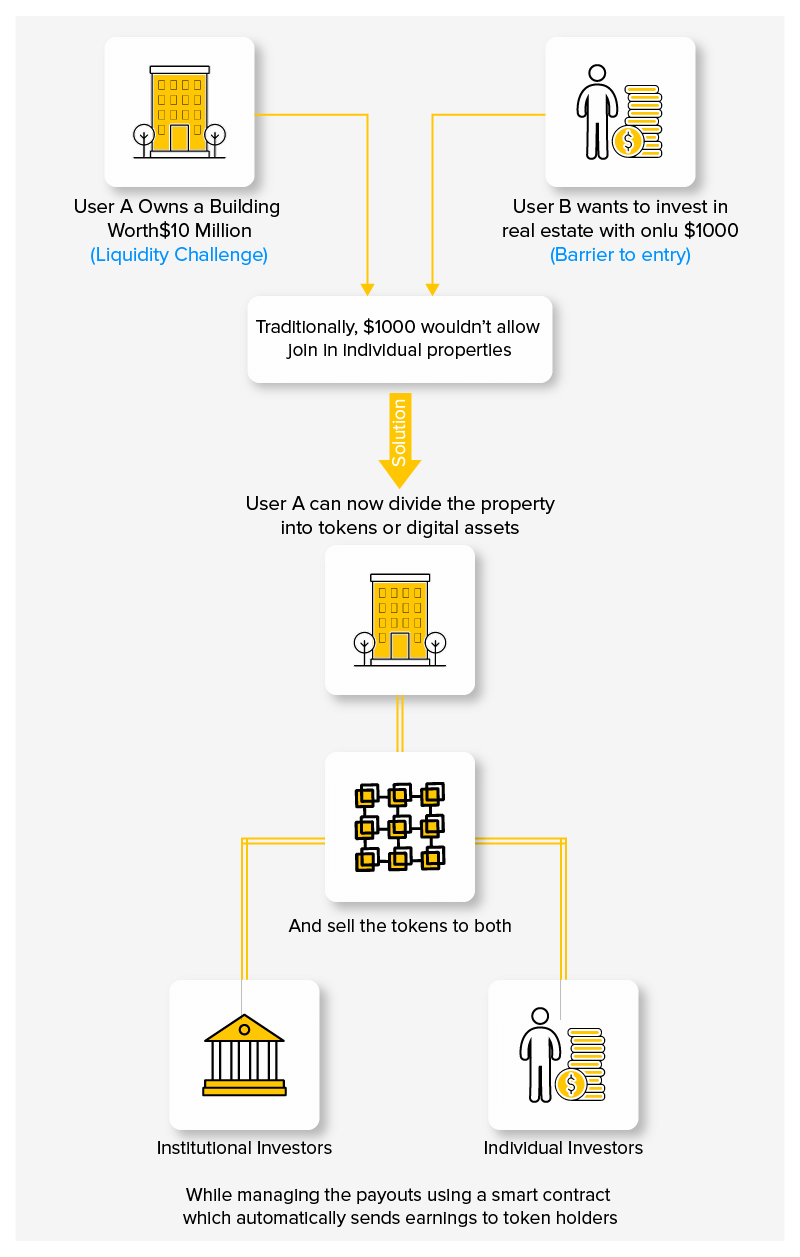

2. Real Estate

Real Estate is yet another business domain that leverages higher benefits with the introduction of tokenization.

The concept of real estate tokenization streamlines the investing process. It eliminates the intermediaries, making it easier and cost-effective for buyers and sellers to interact with each other. It also let anyone invest any amount, which further results into a better marketplace for all.

Besides, this concept reduces the risk of fraud. Something because of which 66M buildings will be tokenized on Ethereum Blockchain in record deal soon.

A real use case of real-estate companies using the power of tokenization is Carribean-based company, La Estancia Holdings.

1. Healthcare

Healthcare sector is also turning towards tokenization to settle down some major issues prevailing these days.

Tokenization replaces sensitive patient data like PANs, NPPI, and ePHI with unique and non-sensitive values, which reduces the data breach cases. It also transfers the power to create, access, and share sensitive data from the intermediaries like insurance companies to patients and medical organizations. And in this way, tokenization of healthcare processes and information empowers patients to validate the accuracy of their data, while saving hefty amount offered to these third parties.

The partnership of ridesharing app Lyft with blockchain startup, Solve.Care to tokenize healthcare-related transport arrangements is an example of implementation of tokenization in Healthcare domain.

2. Sports

Another industry that experiences significant positive changes with the adoption of Blockchain and tokenization is Sports industry.

Tokenization of assets decentralizes the whole marketplace, making it easier for investors and fans to invest in their favorite sports players and clubs trade the gained benefits. This further helps sports clubs and players to meet their financial needs and perform in this field more effectively and profitably.

Various sports clubs and firms have already started looking into this direction, while many are planning to embrace the concept. And one such example is the recent Manchester City and Superbloke partnership.

3. Enterprise

Enterprises also harness the potential of tokenization in its monumental shift to Blockchain. They consider this concept to extend their approach to new markets, evaluate employee performance, ensure proper resource allocation, introduce better incentive models, and add transparency to all the internal processes.

Additionally, Enterprises introduce different tokens for different assignment types to give a tailored experience. They set an award for particular amount of tokens which helps in showing their importance in concrete terms. Something that is beyond the scope of labels ‘high-priority’ and ‘urgent’, which product managers were using earlier.

The concept of tokenization of assets will enter many more business verticals. It will hit a market of $2.25B by 2020, with a CAGR of 22.4%, which gives an impression that introducing this concept into your business vertical is not a bad idea.

So, taking the same thought forward, let’s look into what approach does blockchain app developers like those at Appinventiv follows for designing tokens, followed by what all factors must be taken into consideration.

How Appinventiv Introduces Tokenization in Your Existing Business Model?

At Appinventiv, we understand that the process of creating tokens that suit your business needs depends on various factors (something we will uncover in the next part of this article). We then make a plan and prepare the right infrastructure for the tokenization process. Later, we launch an asset in blockchain environment and make it publicly available for performing different exchanges.

With this attended to, let’s turn towards the factors that we and various other blockchain application development companies consider when performing tokenization of assets.

Factors to Consider Before Entering Token Economy

1. Business Model

When it comes to investing in tokenization, the foremost decision is to determine the right business model depending on different factors, including:-

- The decision of acting as an advice issuer on how to build a token or be a keeper of token.

- The decision of whether to reap higher benefits being a custodian to develop life cycle event transactions using distributed ledger, or introduce smart contracts into the tokenized world.

- The choice of performing as a central distributor for providing access to transact on various tokenization platforms or maintaining user accounts on cryptocurrencies.

2. Platform Integration Process

Depending on the business model selected, you can execute different operating models. This includes choosing the right platform users will employ or collaborate with.

Now, this decision again varies with different factors, such as:-

- Type of Products/Services to be offered,

- Nature and Size of the target audience,

- Infrastructure involved, and

- Regulations to be followed.

3. Cybersecurity

With the growing implementation of cryptocurrencies in the business world, the risk of cyberattacks is also increasing. Though the distributed ledgers are themselves offering a higher degree of security using the concept of consensus and cryptology mechanisms, there are still various weak points.

So, it is again imperative for companies to focus on regulating the right security measures into the process of tokenization at different levels.

4. Compliances

In the token economy, business interactions are unswerving, quick, and immutable. Because of this, it is imperative to implement the right operational measures that comply with the regulations. It is required to bring the new participants like KYC utilities and blockchain analytic software vendors forward for implementing better operational measures.

When focused on the aforementioned factors, the process of tokenization of assets can bring better results. It can create better opportunities and solutions to existing challenges, resulting into a highly-secured and efficient economy.

However, the potential of blockchain-backed tokenization will not remain confined to business domains. It will also help other technologies like AI and IoT etc. deliver a better experience.

strategies your digital product..